Unexpected Tax Benefits of Personal Loans in Utah — What Smart Borrowers Need to Know

When most people think about personal loans in Utah, they imagine quick cash for emergencies, consolidating debt, or funding big purchases. But few realize there

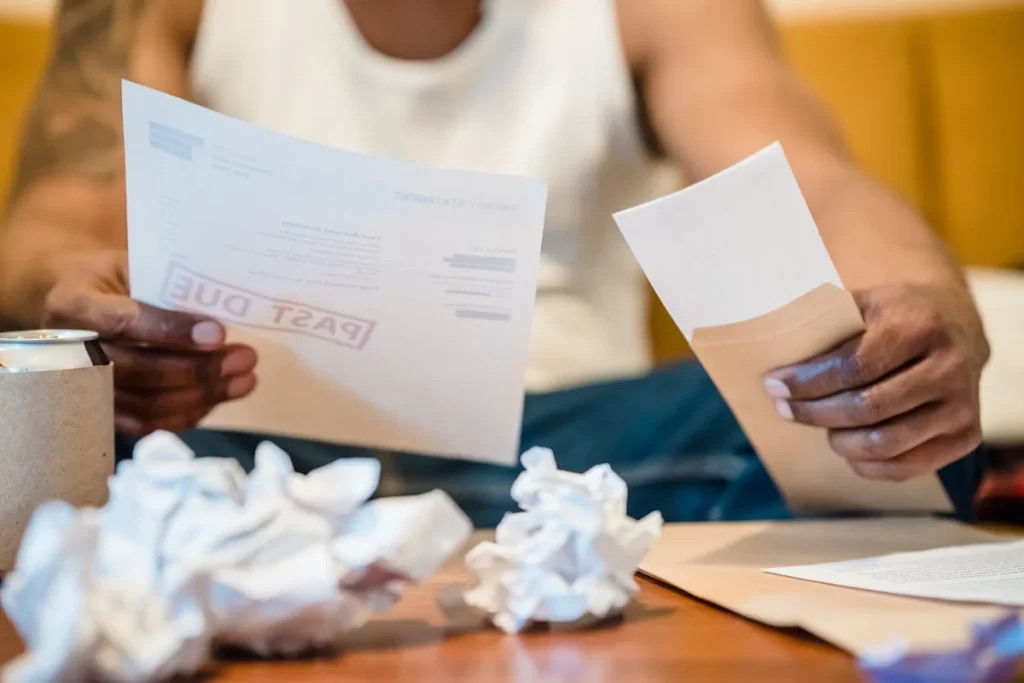

Being in debt is one of the most stressful situations anyone can experience. According to the Federal Reserve Bank of New York, the total household debt in the U.S. increased by $184 billion to reach $17.69 trillion.

Whether it’s credit card debt, auto or student loans, mortgage debt, or simply money borrowed from a friend, it can put a strain on your financial and emotional well-being.

What’s more, the longer you remain in debt, the more your balance grows due to interest, making you feel more stuck than ever. But if you are serious about paying off your debt, it is more than possible to do it quickly.

So how to get out of debt fast? Read on to explore our 3 proven ways to pay off your debt fast.

It’s not always the best idea to get rid of debt fast. For instance, if you have a low-interest loan, instead of trying to pay it off fast, you can put that extra money into a high-yield savings account. This way, you will end up getting better returns.

But if you have high-interest debts, it’s better to pay off your debts fast to save money. Below are some of the most effective ways to get out of debt fast:

While you may have heard of the snowball method that tells you to pay off the lowest balance first and snowball towards bigger balances, it may not always be the best idea.

In many cases, the debts with higher balances may also have higher interest rates. So the longer you wait to pay them off, the more the interest will accrue.

Therefore, you should follow the debt avalanche method by paying off the debts with the highest interest rate first. This way, you can end up saving much more money.

However, always consider your overall financial situation before making any decision. For instance, if you have already passed your credit limit on a low-interest loan with a high balance, it makes sense to pay it first.

To get out of debt fast, you will need cash to pay it off. It’s as simple as that. There are two ways to improve your cash flow — you can either look for ways to make more money, or you can cut down on your spending.

For instance, you can find a side hustle like driving Uber, babysitting, dog walking, or delivering food. You can also look for online freelance jobs to make money remotely. Additionally, you can sell off older possessions that you no longer use.

If you can’t find a way to make more money, consider freeing up your existing funds. Cut down on your spending by prioritizing your needs over your wants, eating in, and skipping coffee pickups from the local coffee shop.

Until you are able to pay off your debts, stick to a budget. Make sure that whatever money goes towards paying off your debt.

Debt consolidation is a great strategy to reduce stress and lower the number of monthly debt payments that are due. With debt consolidation, you can combine all of your existing loans into a new loan so that you only have to make a single payment every month.

Debt consolidation is ideal for paying off credit cards and personal loans. It also comes with a lower interest rate, so you can possibly even save money at the end.

If you are looking for debt consolidation loans, Cash in Minutes offers low-interest debt consolidation loans to reduce your financial stress and help you pay off your loans more simply and quickly. Apply today regardless of your credit score to get same-day funding.

With these proven strategies, we hope you can get out of debt quickly. Do remember to stick to a budget and try to break the cycle of getting into debt again and again. It’s important to stop the debt cycle by focusing on saving money.

You should at least have a few months’ worth of expenses saved up. And even if you do need to take out a loan for an emergency, make sure you’re taking out a low-interest loan.

Good luck!

Smooth and protected, embark on a fast track to a cash loan with simple steps. Access your funds promptly!

Questions or need assistance? Our dedicated team is here to help you with all your cash loan inquiries. Contact us now!

When most people think about personal loans in Utah, they imagine quick cash for emergencies, consolidating debt, or funding big purchases. But few realize there

When money emergencies strike, you don’t have time to wait days for approval or paperwork. Whether it’s a medical bill, car repair, or rent due

Identity theft can happen to anyone and often when you least expect it. One of the most powerful ways to protect yourself is by freezing

When unexpected medical bills hit, they don’t just affect your health. They can also take a heavy toll on your finances. From sudden ER visits

Don’t wait any longer!

Start your application today.

+1 (801) 919-3200

Monday through Friday 9am to 5:30pm

424 North Freedom Blvd Provo, Utah 84601